Hydrocarbon Information System

In the Hydrocarbons Information System (SIH), you can view and download the historic production of oil and gas by well, as well as other statistics of interest regarding the Mexican oil sector provided by the National Hydrocarbons Commission.

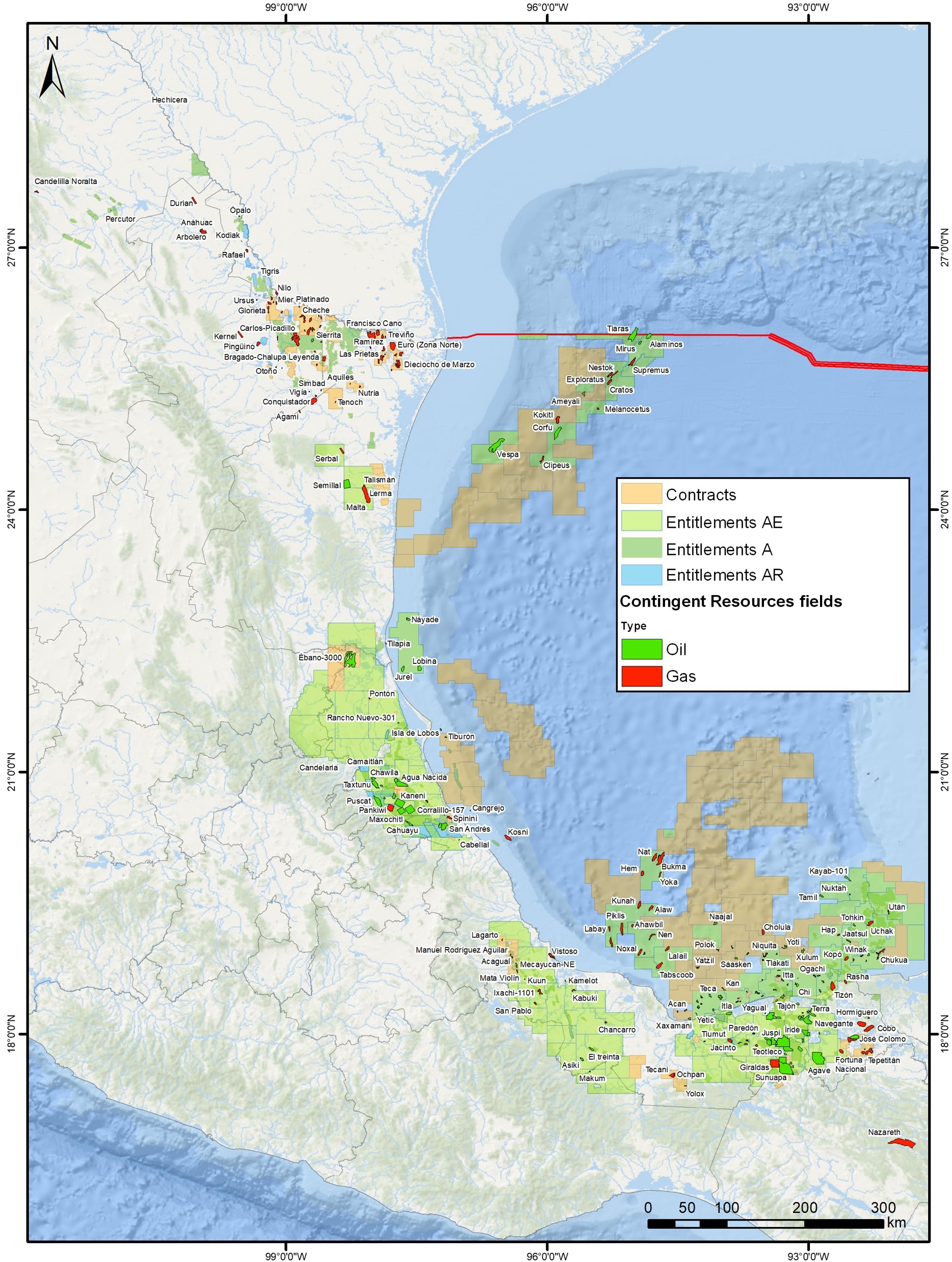

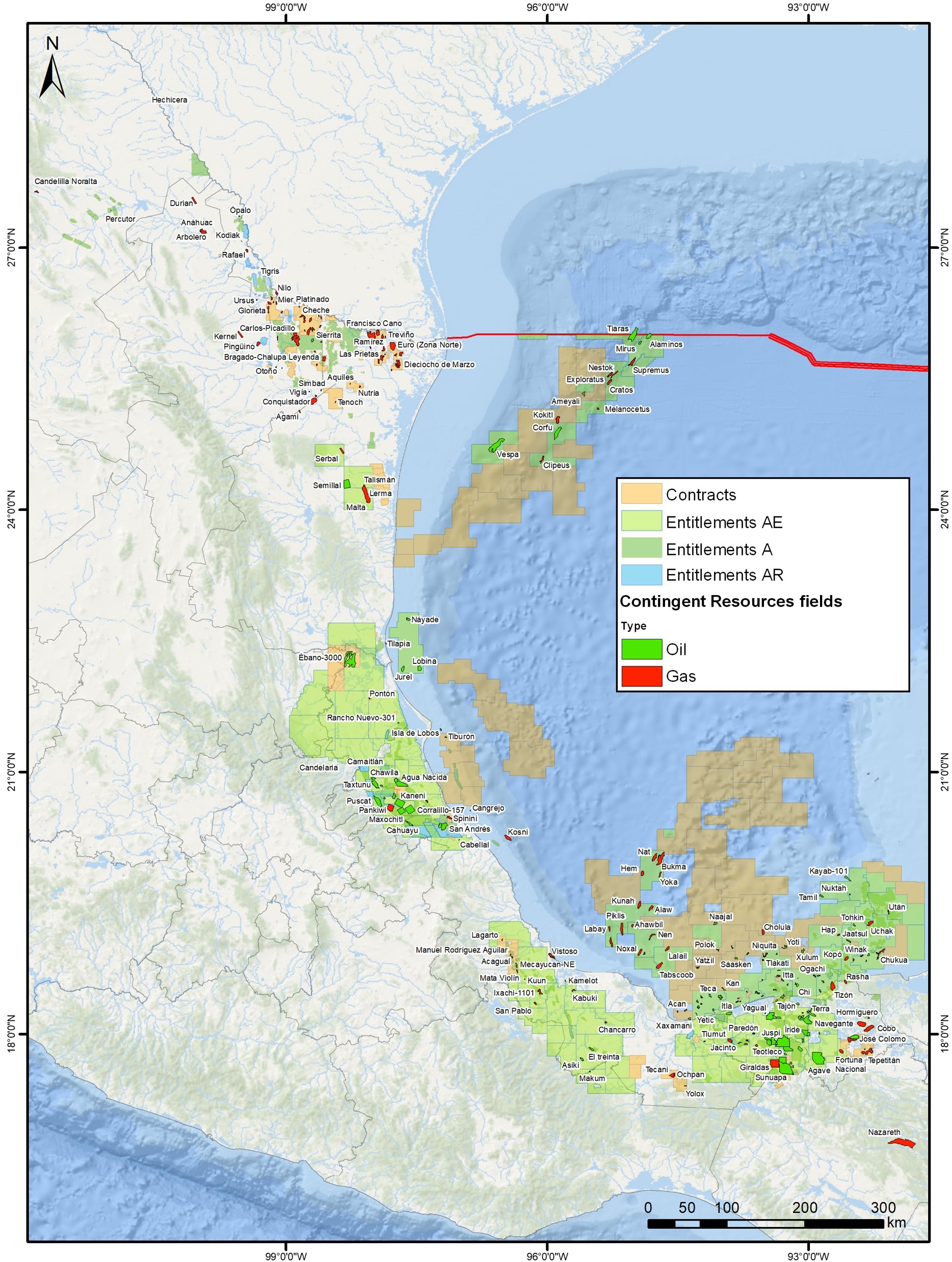

Contingent Resources

Contingent Resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations by application of development projects but which are not currently considered to be commercially recoverable owing to one or more contingencies.

Under the Regulation on Prospective and Contingent Resources1/ issued by the National Hydrocarbons Commission (CNH), it tracks the country’s Hydrocarbon Resources from their evaluation and quantification as Prospective Resources to their incorporation as Reserves. During 2023, there is a record of 69 drilled exploration prospects, whose total mean Prospective Resources estimate was 6,121 MMboe, from which 28 new discoveries were made that incorporated 372 MMboe of new 3C Contingent Resources and 488 MMboe of 3P Reserves.

On the other hand by 2024, the volume of 3C Contingent Resources increased 6% compared to 2023. This because the volume of 17 new discoveries and the volume incorporation from reservoir level updates in 6 more fields.

In balance for 2023, 1.6% of the 3P Reserves (372 MMboe) were incorporated from new discoveries (1.6%) and by the reclassification of Contingent Resources to Reserves 700 MMboe were added, equivalent to 3% of the total 3P Reserves.

PRMS Contingent Resources Classification

For the exercise of CNH duties regarding the classification of Contingent Resources estimates, the Petroleum Resources Management System (PRMS) is adopted, in its current English version, as the reference system.

This classification system defines subclasses for Contingent Resources, which are related to the maturity level of the projects and the business decisions to be implemented, positioning the project's status in the value chain.

Development pending: A discovered accumulation where project activities are ongoing to justify commercial development in the foreseeable future.

Development on hold: A discovered accumulation where project activities are on hold and where justification as a commercial development may be subject to significant delay.

Development unclarified: A discovered accumulation where project activities are under evaluation and where justification as a commercial development is unknown based on available information.

Development not viable: A discovered accumulation for which there are no current plans to develop or to acquire additional data at the time because of limited commercial potential.

1/ According to CNH Regulation on Prospective and Contingent Resources, the Contingent Resources Report provided by the Operators is informative and does not involve auditing or validation by an Independent Third Party (Reserves Evaluators) https://cnh.gob.mx/media/16413/lineamientos-de-recursos-prospectivos-y-contingentes.pdf.

National production

Oil |

1,712.7 |

Thousand barrels per day |

Natural gas |

4,995.3 |

Million cubic feet per day |

Nitrogen-free Natural Gas |

3,972.8 |

Million cubic feet per day |

Condensate |

26.6 |

Thousand barrels per day |

National production of hydrocarbons since 1960, disaggregated by license/entitlement or contract, location (state) and main production project. It includes natural gas production.

This section includes statistics related to Prospective Production of Hydrocarbons, calculated using information from Development Plans submitted by Operators and estimates made by the National Hydrocarbons Commission.

Reserves

3P |

25,106.1 |

MMBOE |

2P |

15,836.2 |

MMBOE |

1P |

7,897.3 |

MMBOE |

Prospective resources

Total |

112,833.3 |

MMBOE |

Conventional |

52,629.1 |

MMBOE |

Unconventional |

60,204.3 |

MMBOE |

Hydrocarbons national reserves, by category 1P, 2P and 3P, disaggregated by oil field and license/entitlement or contract. It includes prospective resources and the relationship between production and reserves.

Wells

Total drilled wells |

25 |

Exploratory wells |

4 |

Development wells |

21 |

Operating wells |

7,873 |

Exploration studies (ARES)

Total studies |

52 |

Developing |

20 |

Completed |

32 |

ARES register |

86 |

Companies with authorizations |

21 |

Indicators of the evolution of the oil industry in Mexico, such as the number of wells drilled and finished, disaggregated by type of well, location and operator. It includes the number of drilling rigs and the number and type of hydrocarbon-producing wells.

| 412 | Entitlements |

| 103 | Contracts |

Entitlements existing

Entitlements |

413 |

Exploration |

110 |

Extraction |

258 |

Shelter |

45 |

Contracts existing

Contracts |

111 |

Bidding process |

103 |

Pemex farmouts |

3 |

Pemex migrations |

5 |

Management of licenses/entitlements, contracts and tender processes in the hydrocarbons sector. It includes information related to the technical management and monitoring of licenses/entitlements and contracts.

Oil

WTI |

56.81 |

Dollars per barrel |

Brent |

62.68 |

|

MME |

49.41 |

Gas

Henry Hub |

2.71 |

Dollars per million BTU |

IPGN - CRE |

3.19 |

Investment in Contracts

Committed investment |

4.158 |

Billion dollars |

Approved investment |

36.406 |

Billion dollars |

Disbursed investment |

3.009 |

Billion dollars |

Hydrocarbons payments

Total |

117.983 |

Billion dollars |

Entitlements |

115.772 |

Billion dollars |

Contracts |

2.211 |

Billion dollars |

In this section, you will find information regarding investments in Exploration and Extraction Contracts disaggregated by type:

- Estimated investment, showing total capital investment during project lifespan assuming commercial success.

- Committed investment, according to the Minimum Work Program stipulated in each Contract.

- Approved investment in Exploration and Development Plans.

- Disbursed investment, using information on costs, expenses and investments registered with the Mexican Oil Fund.

In addition, you will find information regarding investments in Licenses/Entitlements, information investments as well as payments made to the Mexican Oil Fund by Licensees and Operators.

In the Hydrocarbons Information System (SIH), you can view and download the historic production of oil and gas by well, as well as other statistics of interest regarding the Mexican oil sector provided by the National Hydrocarbons Commission.

Contingent Resources

Contingent Resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations by application of development projects but which are not currently considered to be commercially recoverable owing to one or more contingencies.

Under the Regulation on Prospective and Contingent Resources1/ issued by the National Hydrocarbons Commission (CNH), it tracks the country’s Hydrocarbon Resources from their evaluation and quantification as Prospective Resources to their incorporation as Reserves. During 2023, there is a record of 69 drilled exploration prospects, whose total mean Prospective Resources estimate was 6,121 MMboe, from which 28 new discoveries were made that incorporated 372 MMboe of new 3C Contingent Resources and 488 MMboe of 3P Reserves.

On the other hand by 2024, the volume of 3C Contingent Resources increased 6% compared to 2023. This because the volume of 17 new discoveries and the volume incorporation from reservoir level updates in 6 more fields.

In balance for 2023, 1.6% of the 3P Reserves (372 MMboe) were incorporated from new discoveries (1.6%) and by the reclassification of Contingent Resources to Reserves 700 MMboe were added, equivalent to 3% of the total 3P Reserves.

PRMS Contingent Resources Classification

For the exercise of CNH duties regarding the classification of Contingent Resources estimates, the Petroleum Resources Management System (PRMS) is adopted, in its current English version, as the reference system.

This classification system defines subclasses for Contingent Resources, which are related to the maturity level of the projects and the business decisions to be implemented, positioning the project's status in the value chain.

Development pending: A discovered accumulation where project activities are ongoing to justify commercial development in the foreseeable future.

Development on hold: A discovered accumulation where project activities are on hold and where justification as a commercial development may be subject to significant delay.

Development unclarified: A discovered accumulation where project activities are under evaluation and where justification as a commercial development is unknown based on available information.

Development not viable: A discovered accumulation for which there are no current plans to develop or to acquire additional data at the time because of limited commercial potential.

1/ According to CNH Regulation on Prospective and Contingent Resources, the Contingent Resources Report provided by the Operators is informative and does not involve auditing or validation by an Independent Third Party (Reserves Evaluators) https://cnh.gob.mx/media/16413/lineamientos-de-recursos-prospectivos-y-contingentes.pdf.

National production of hydrocarbons since 1960, disaggregated by license/entitlement or contract, location (state) and main production project. It includes natural gas production.

This section includes statistics related to Prospective Production of Hydrocarbons, calculated using information from Development Plans submitted by Operators and estimates made by the National Hydrocarbons Commission.

Hydrocarbons national reserves, by category 1P, 2P and 3P, disaggregated by oil field and license/entitlement or contract. It includes prospective resources and the relationship between production and reserves.

Indicators of the evolution of the oil industry in Mexico, such as the number of wells drilled and finished, disaggregated by type of well, location and operator. It includes the number of drilling rigs and the number and type of hydrocarbon-producing wells.

| 111 | Contracts |

| 413 | Entitlements |

Management of licenses/entitlements, contracts and tender processes in the hydrocarbons sector. It includes information related to the technical management and monitoring of licenses/entitlements and contracts.

In this section, you will find information regarding investments in Exploration and Extraction Contracts disaggregated by type:

- Estimated investment, showing total capital investment during project lifespan assuming commercial success.

- Committed investment, according to the Minimum Work Program stipulated in each Contract.

- Approved investment in Exploration and Development Plans.

- Disbursed investment, using information on costs, expenses and investments registered with the Mexican Oil Fund.

In addition, you will find information regarding investments in Licenses/Entitlements, information investments as well as payments made to the Mexican Oil Fund by Licensees and Operators.